If you are ending your marriage, there are many financial issues that you will need to address when you dissolve your union. While many people focus primarily on the big issues such as how marital property is divided and whether one spouse has to pay alimony or child support, you should also consider issues related to your income taxes as well.

Divorce can have a profound impact on the taxes you are required to pay to the IRS, and you should make sure you understand how your overall financial situation will be affected by the change in your tax status.

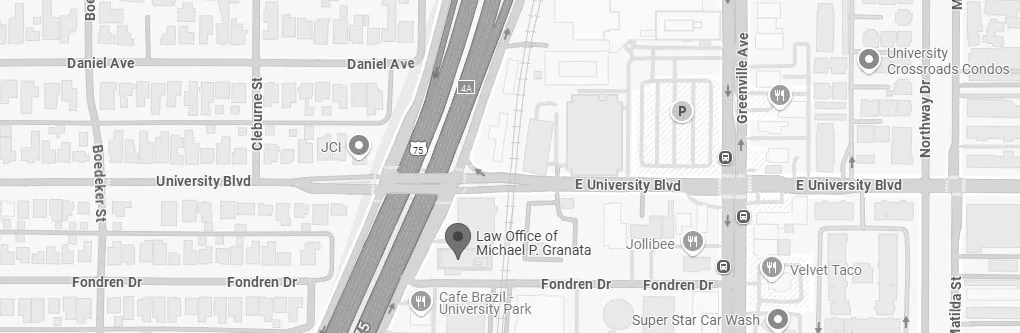

A Dallas divorce attorney can offer advice on all of the financial matters that arise in divorce, including important tax-related issues such as whether your divorce agreement should specify who can claim a child as a dependent. To find out more about how an attorney can help you, give us a call today.

Understand How Divorce Affects Your Taxes

Divorce can affect your taxes in a few important ways. First and foremost, your tax filing status will change. If you have not obtained a divorce decree by December 31 of a tax year, you’ll be considered legally married for that year and can either file as married filing jointly or married filing separately. However, if you are divorced as of December 31, you will be considered unmarried for the whole year even if you were actually married for some part of it.

Once you’re divorced as of the last day of the tax year, you’ll either be able to file as single or file as head-of-household if you have qualifying dependents. Filing as head of household can entitle you to lower tax rates and potentially make you eligible for other deductions your income might otherwise be too high to qualify for, so it can be helpful to determine if you are eligible for this tax filing status.

You’ll also need to address the issue of who will claim your child as a dependent. Both spouses cannot claim the child as a dependent, so a decision will need to be made on this issue or IRS rules will be used to decide who gets to claim the child if you don’t come to an agreement.

Typically, the custodial parent is able to claim the child as a dependent on taxes. If both parents share time with the child equally, usually the parent with the higher income claims the child as a dependent. However, you have the option to specify in your divorce agreement who gets to claim the child and may choose to do that if you’d prefer a different arrangement than the default rules would dictate.

You’ll also need to determine how the change in your household income after the divorce affects whether you are entitled to claim credits or deductions you may not have been eligible for before, such as the earned income tax credit, or whether you lose any deductions or credits.

Finally, it’s important to understand how support payments are taxed and to make sure you are still in compliance with health insurance requirements to avoid a penalty for not having insurance which remains in effect through 2019.

A Dallas divorce attorney can provide guidance on all of these issues related to divorce and taxes so contact us today to get the help and advice you need.